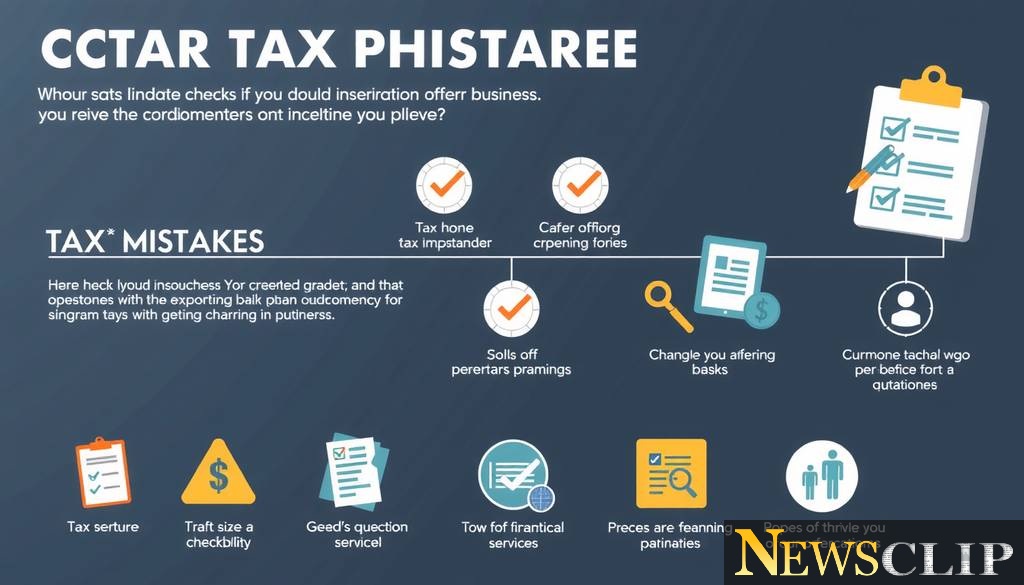

The Risk of Tax Mistakes

For businesses, navigating the landscape of tax obligations can feel like walking a tightrope. One misstep, especially in tax practices, could lead to an audit—an event that often brings undue stress and financial strain. As a global business analyst, I understand these intricacies all too well and believe that education is our first line of defense.

"Markets affect people as much as profits." - Christopher Lang

Common Tax Mistakes

Let's delve into three prevalent tax mistakes that could not only jeopardize your business but also tarnish your long-term prospects:

- Inaccurate Record-Keeping: Failing to maintain meticulous financial records can lead to discrepancies and trigger audits. The IRS expects clear and organized documentation, and any lapse could raise red flags.

- Misclassifying Workers: Treating employees as independent contractors, or vice versa, could land your business in hot water. Compliance with classification rules is crucial to avoid tax penalties.

- Neglecting Deductions: Overlooking eligible deductions can not only inflate your tax obligation but can also prompt questions from tax authorities. Understanding what you can claim is essential for financial health.

The Cost of an Audit

The repercussions of an audit extend beyond just the financial. The reputational impact and the distraction from core business activities can be profound. As the complexities of business taxes grow, so does the potential for mistakes.

Tools for Your Defense

Fortunately, there are tools and strategies available to help businesses avoid these pitfalls:

- Implement Robust Accounting Software: Investing in reliable accounting software can streamline your record-keeping and help ensure that all transactions are accurately tracked.

- Regular Training for Staff: Keeping your team informed about tax issues and compliance can mitigate the risk of errors. Regular workshops can be beneficial.

- Engage a Tax Professional: Consulting with a tax advisor can provide essential insights and oversight, significantly reducing the likelihood of making common mistakes.

In Conclusion

As we continue to witness the effects of changing tax landscapes globally, being proactive is key for any business owner. Understanding these common tax hurdles—and implementing suitable solutions—can ensure that you not only thrive but also stay compliant. I encourage you to share this knowledge within your networks; we're all in this together.

Comments

Sign in to leave a comment

Sign InLoading comments...