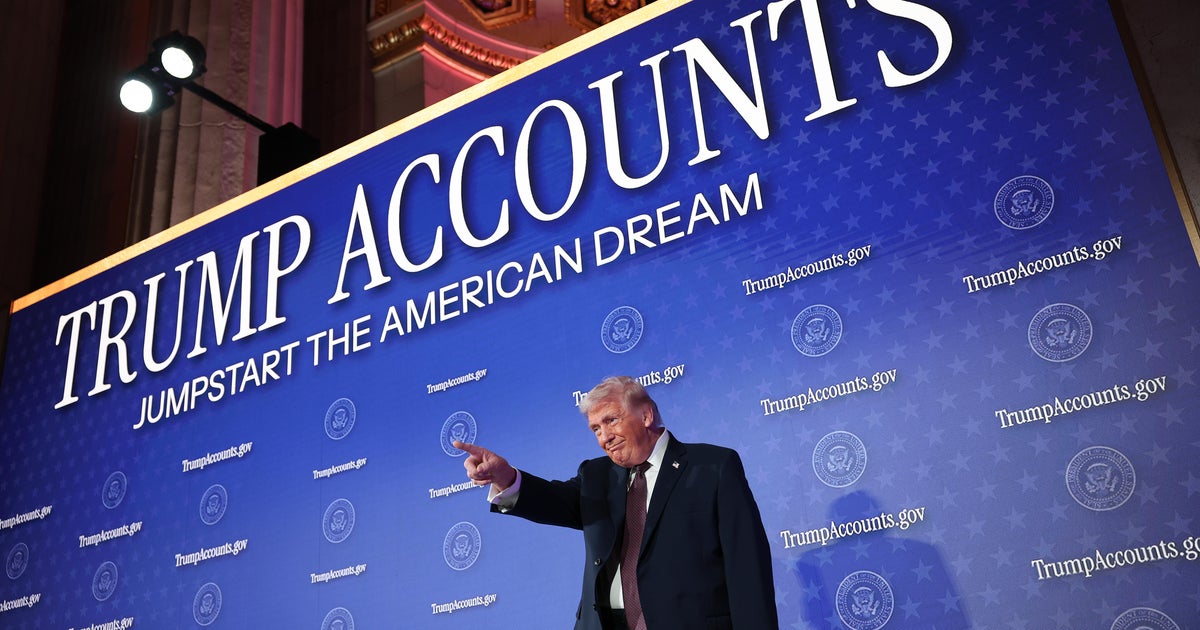

Introduction: A New Savings Initiative

In a remarkable convergence of corporate and government interests, two of America's largest financial institutions, Bank of America and JPMorgan Chase, have announced that they will each contribute an additional $1,000 to employees who opt into a new savings vehicle dubbed the 'Trump Account.' This initiative echoes President Trump's vision for a financial opportunity that aims to empower families and enhance their financial futures.

Understanding the Trump Accounts

Envisioned as a tool for economic empowerment, the Trump Account is a federally-backed savings plan designed for children born in the United States between January 1, 2025, and December 31, 2028. Each account will be seeded with an initial federal investment of $1,000, with the money subsequently invested in the stock market for potential growth. The strategy aims to instill a habit of savings from an early age, conceiving a generation raised with a solid financial foundation.

The Corporate Commitment

JPMorgan Chase CEO Jamie Dimon articulated the bank's commitment to improving the financial well-being of its employees and their families, stating, "By matching this contribution, we're making it easier for them to start saving early, invest wisely, and plan for their family's financial future." Similarly, Bank of America has echoed this sentiment, pointing to a trend of corporate responsibility towards employee financial wellness.

Reactions from the Financial Industry

The response from other corporations has been enthusiastic. Renowned tech giant Intel has also made a pledge to contribute to its employees' Trump Accounts, highlighting a growing trend among businesses to align with government initiatives that aim at social betterment. Visa's innovative approach allows credit card holders to contribute to the account using rewards earned from everyday purchases, further alleviating the burden of traditional saving.

"We applaud that the federal government is providing innovative solutions for employees and families to plan for their future," said a Bank of America spokesperson.

The Broader Implications

This alignment of corporate offerings with governmental policy raises crucial questions about the future of savings programs in America. While the ultimate goal appears to be positive - strengthening families' economic stability - one must consider the deeper implications of tying such initiatives to a politically charged figure.

Critics Weigh In

While many lauded the initiative as a generational opportunity, some skeptics question the motives behind the plan and the role of the private sector in public policy. Critics argue that dependence on corporate contributions may lead to a tiered system where not all children benefit equally. Some employees may feel pressured to participate, raising ethical questions regarding voluntary versus compelled participation in these plans.

How Families Can Benefit

Families will officially be able to start contributing to their child's Trump Account as early as July 4, an opportunity for parents to invest in a future that could potentially yield dividends for their children. Aside from the government's contribution, families can deposit a maximum of $5,000 annually into the account, with employers allowed to contribute an additional $2,500 tax-free.

Conclusion: Navigating the Future of Savings

As we venture into this uncharted territory of federally-supported, corporate-driven savings plans, it's crucial to keep an eye on how these policies evolve. The intersection of business philanthropy and government initiatives could redefine financial norms for the next generation. My hope is that through measured approaches and sustained advocacy, we can create a landscape where financial literacy and empowerment become cornerstones of our society, not just privileges of the few.

Source reference: https://www.cbsnews.com/news/trump-accounts-for-kids-jpmorgan-chase-bank-of-america-1000/

Comments

Sign in to leave a comment

Sign InLoading comments...