Unpacking the Illusion

As I reflect on the current state of China's economy, it becomes increasingly apparent that external enthusiasm often belies an undercurrent of significant issues. Investors from the West are re-engaging with China's markets, driven by narratives of a resilient economy and unchecked growth. However, this excitement demands a closer inspection.

The Data Speaks

According to the Institute of International Finance, offshore investments in Chinese equities surged an astounding 443.9% in the first ten months of 2025. Such statistics paint a picture of confidence, yet they mask troubling realities. Many analysts argue that this influx is predicated on belief rather than facts, with investors buying into the myth of China as the next global hegemon.

“Many investors have bought whole hog into the narrative that 'nothing will hinder the global ascendency of China'.” - Rana Foroohar, Financial Times

A Fragile Foundation

Diving deeper, we see that the Chinese economy is experiencing stagnation and distortion. Recent statistics suggest that the official GDP numbers are grossly inflated, masking an economy that is teetering on the edge. Years of reckless over-investment in real estate have produced an alarming surplus of housing—enough, according to former senior statistics official He Keng, to house the entire population of 1.4 billion.

The Failed Economic Model

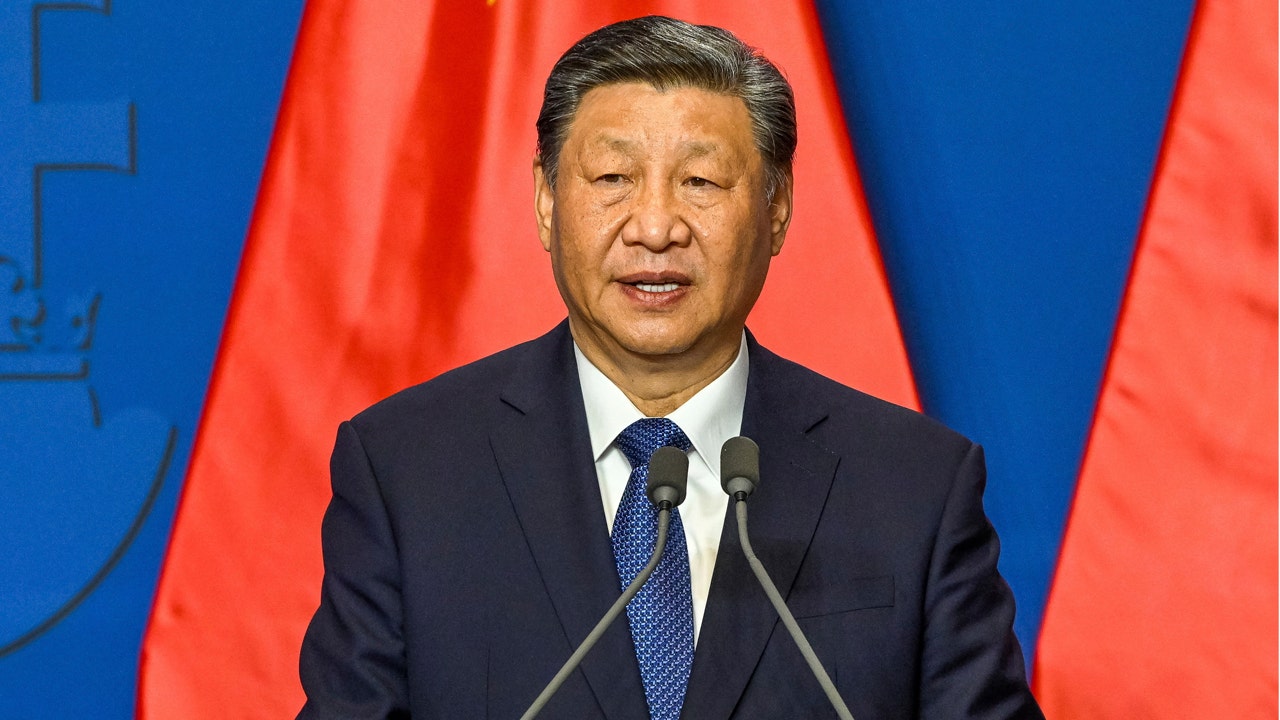

Xi Jinping's leadership has not ushered in reform but rather rigidity within an exhausted economic blueprint. Consider the massive infrastructure projects launched over the years. China's high-speed rail system, although technologically advanced, loses substantial amounts of money and functions more as a political statement than a sound financial venture.

The Social Consequences

As economic instability looms, social discontent has emerged as a potent force. The backlash to stringent COVID lockdowns, combined with a lackluster economic recovery, has ushered in a pervasive atmosphere of malaise among the populace. This socio-economic crisis has given rise to terms like 'lying flat'—where individuals choose to opt out of societal expectations entirely.

Cracks in the Surface

Now, we see the psychological toll manifesting in societal trends: birth rates plummeting and a growing sense of hopelessness. A generation characterized by passive resignation views the future with increasing trepidation. The continuing unrest challenges the very fabric of Chinese society and should not be overlooked while assessing economic prospects.

Disconnect in Policy

Despite these signs, Xi Jinping's administration appears to be taking a hard line, opting for censorship against what they define as 'excessively pessimistic sentiment.' This lack of engagement with the populace is itself a recipe for disaster, as it dismisses the legitimate concerns of everyday citizens.

The Future Looks Bleak

Consumption in China now contributes merely 38% of GDP—one of the lowest rates globally. Rather than recalibrating their approach to empower the common people, Xi continues to push pro-industrial policies. His confidence belies the warnings from economists that an export-driven growth strategy is unsustainable in a world that can no longer absorb ever-increasing factory outputs.

A Call for Scrutiny

In navigating China's economic landscape, we must maintain a critical lens. The ongoing euphoria among foreign investors risks overlooking the deep-seated issues that could lead to financial repercussions down the line. The soaring figures may attract attention, but investing in a system riddled with economic instability and social discontent is fraught with risks.

As we engage with this topic, I urge us to challenge these prevailing narratives and engage in honest discourse about China's future. The stakes are not just China's; they are global.

Source reference: https://www.foxnews.com/opinion/gordon-chang-chinas-rising-markets-mask-fragile-economy-social-discontent