Introduction

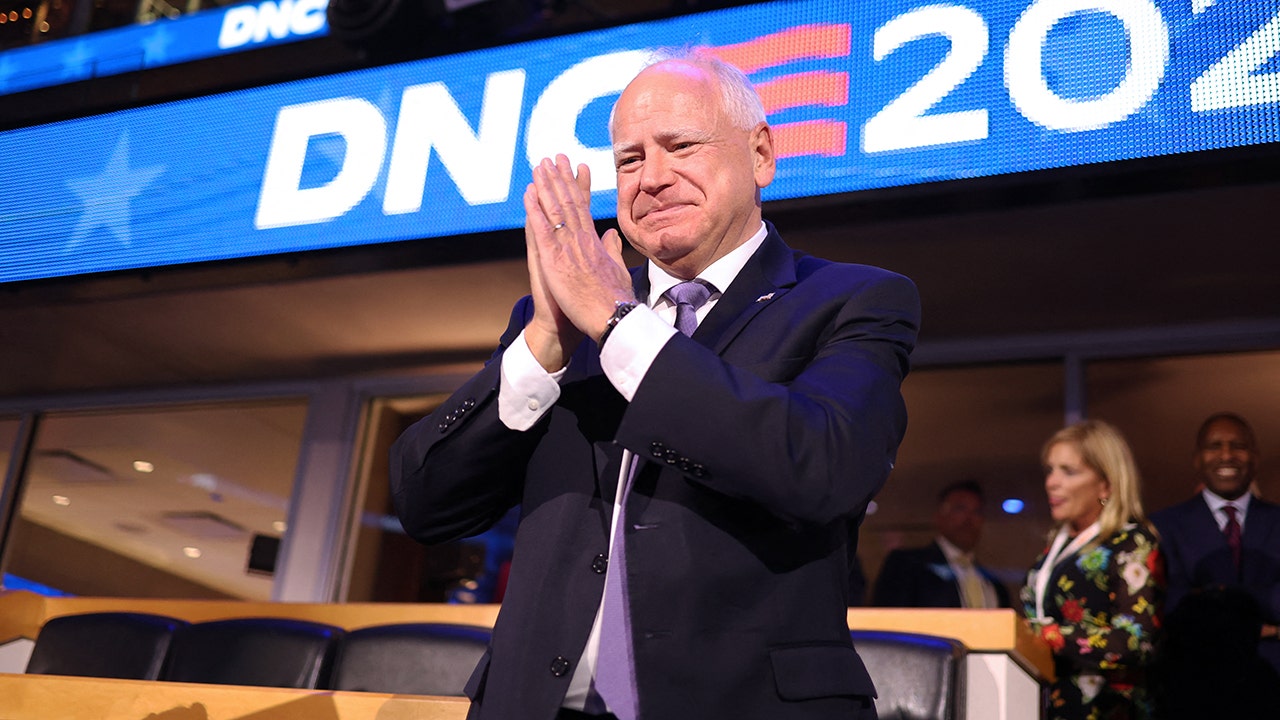

As we sift through the staggering allegations of fraud rocking Minnesota's social services, it's impossible to turn a blind eye to the systemic failures that precipitated the crisis. Under the leadership of Governor Tim Walz, policies purportedly aimed at equity have morphed into an open invitation for exploitation, allowing fraudsters to plunder nearly $9 billion from taxpayer funds.

The Scale of the Crisis

The scale of this fraud is unprecedented, with up to half of the $18 billion allocated for social services reportedly masquerading behind shell companies and fraudulent schemes. As Democrats waived audits and relaxed verification requirements, it became increasingly clear that the bureaucratic machinery failed to protect the interests of vulnerable citizens. In this crisis, we witness not just individual greed but a systematic breakdown of accountability.

“Fraud protections have been deliberately bypassed in the pursuit of progressive political goals.”

Key Players and Their Role

The nexus of this fraud lies in the very institutions that are meant to safeguard taxpayer money. Governor Tim Walz and his administration have been under scrutiny for failing to act on crucial whistleblower reports and for disregarding regulatory safeguards. Every waiver of oversight appears to invite nefarious actors into a system designed to be protective.

The Political Reaction

In the heated exchanges among lawmakers, the divide is stark. Republicans have been vocal in their outrage, labeling the situation as a complete failure of leadership, while Democrats have downplayed the severity. Their narrative depicts accusations of fraud as politically motivated, conveniently neglecting the reality unfolding around them. This denialism not only perpetuates the fraud but also endangers the integrity of the institutions we rely on.

Impact on Vulnerable Populations

This situation will not just affect the balance sheets; it profoundly impacts the vulnerable populations that these services were designed to protect. According to estimates, at least 256,000 children were in the purview of these fraudulent schemes. The implications ripple outwards, harming those the system is meant to serve.

Lessons for Future Governance

Looking ahead, it raises critical issues about governance. If we aim to rebuild trust in our institutions, we must insist on frameworks that prioritize integrity and accountability over speed and equity. Democrats' staunch refusal to implement safeguards, even during a healthcare crisis, has revealed a troubling propensity to place political agendas over fiscal responsibility.

Broader Implications

The ramifications extend beyond the borders of Minnesota. The federal government's COVID-19 relief programs epitomize the flaws in our approach to social services. The $1.9 trillion American Rescue Plan unleashed a wave of fraud that practitioners estimated could reach $420 billion. How much longer will the American public tolerate governance built on systemic loopholes?

A Call to Action

The time has come for robust investigative efforts to root out corruption across all levels of government. We owe it to the taxpayers to demand transparency and accountability. Our financial systems must be designed with inherent fraud protections, not as an afterthought.

Conclusion

As this story continues to unfold, one fact remains clear: the treasury has become a playground for criminals, and the stakes couldn't be higher. It is incumbent upon us, as citizens and journalists, to call for reform and vigilance.

Source reference: https://www.foxnews.com/opinion/jason-chaffetz-democrats-turned-our-treasury-piggy-bank-fraudsters