Confronting the Fraud Epidemic

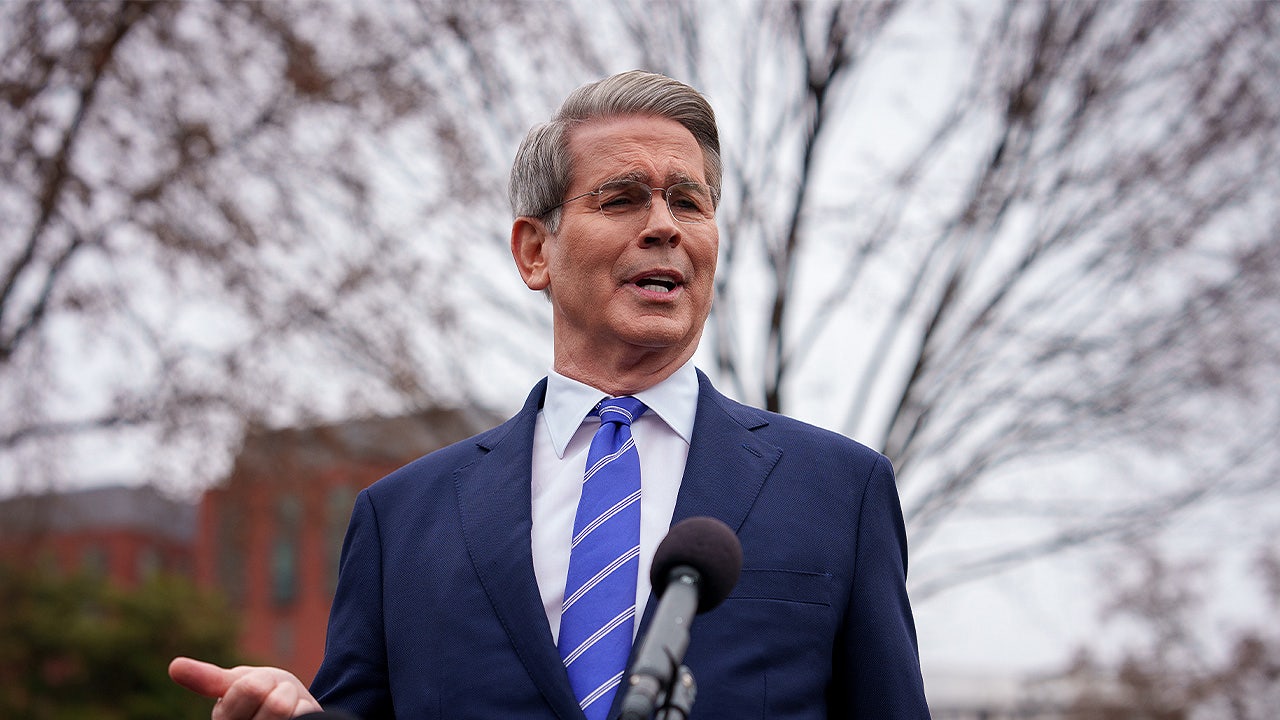

The recent investigation launched by the U.S. Treasury Department into Minnesota's fraud rings reveals a complex web of deceit that has exploited the state's benevolent aura. Under the leadership of Treasury Secretary Scott Bessent, this monumental effort aims to dismantle a multibillion-dollar scheme that has seen funds originally allocated for social services funneled overseas.

Unprecedented Scale

Over the past few years, the so-called "Minnesota nice" environment has been capitalized on by criminals who have perpetrated one of the most egregious frauds in our nation's history. Taxpayer dollars, intended for vulnerable communities — including children, seniors, and individuals with disabilities — have instead been funneled into the coffers of fraudsters, many of whom lack even a legitimate claim to U.S. citizenship.

“We're not just uncovering individual cases of fraud; we're identifying a systematic abuse that speaks to a deeper failure in oversight.”

A National Response

In a decisive step, President Trump has initiated what could be the largest anti-fraud campaign of the 21st century, signaling that extraordinary crime demands extraordinary solutions. Our investigation has revealed disturbing links between these fraud rings and international criminal networks, particularly in Somalia.

Cracking Down on Abuse

The investigation includes collaboration with local authorities in Minnesota, who are expressing frustration at the slow pace of previous efforts to curtail this corruption. The Treasury's Financial Crimes Enforcement Network (FinCEN) is gearing up to hold banks accountable, evaluating whether they have complied with the Bank Secrecy Act, a crucial measure that aims to prevent money laundering.

Financial Accountability and Transparency

Moreover, Bessent emphasizes that the department is not merely reactive; it is adopting proactive measures by providing incentives for whistleblowers. By urging community members to report fraudulent activities, we aim to galvanize collective action against these pervasive networks.

The Geographic Targeting Order

FinCEN has also enacted a Geographic Targeting Order that mandates banks and money transmitters in Hennepin and Ramsey Counties to report any foreign transactions valued at $3,000 or more. This unprecedented move is designed to cast a wider net when it comes to tracking illicit fund transfers.

The Bigger Picture

While Minnesota finds itself at ground zero, the reality is that fraud of this scale is not unique to the state. The Government Accountability Office estimates that fraud could be costing taxpayers upwards of $500 billion annually across the U.S. states like California, New York, and Illinois are also facing scrutiny for their weak oversight in managing government assistance programs.

A Call for Reform

Ending this practice transcends mere financial recovery; it represents a moral imperative to uphold the integrity of government assistance programs designed to aid those genuinely in need. President Trump's administration has set a precedent by prioritizing the prosecution of fraud on a national scale, aiming for a transformative impact across all states.

In Conclusion

As we transition from the talk of accountability to actionable results, it is imperative that we all remain vigilant. The efforts led by Secretary Bessent signify not just a response to Minnesota's crisis but a clarion call for states nationwide to tighten controls and uphold the sanctity of taxpayer funds. Together, we can tackle this epidemic and restore faith in our government systems.

Source reference: https://www.foxnews.com/opinion/sec-scott-bessent-how-stop-fraud-minnesota-and-across-country