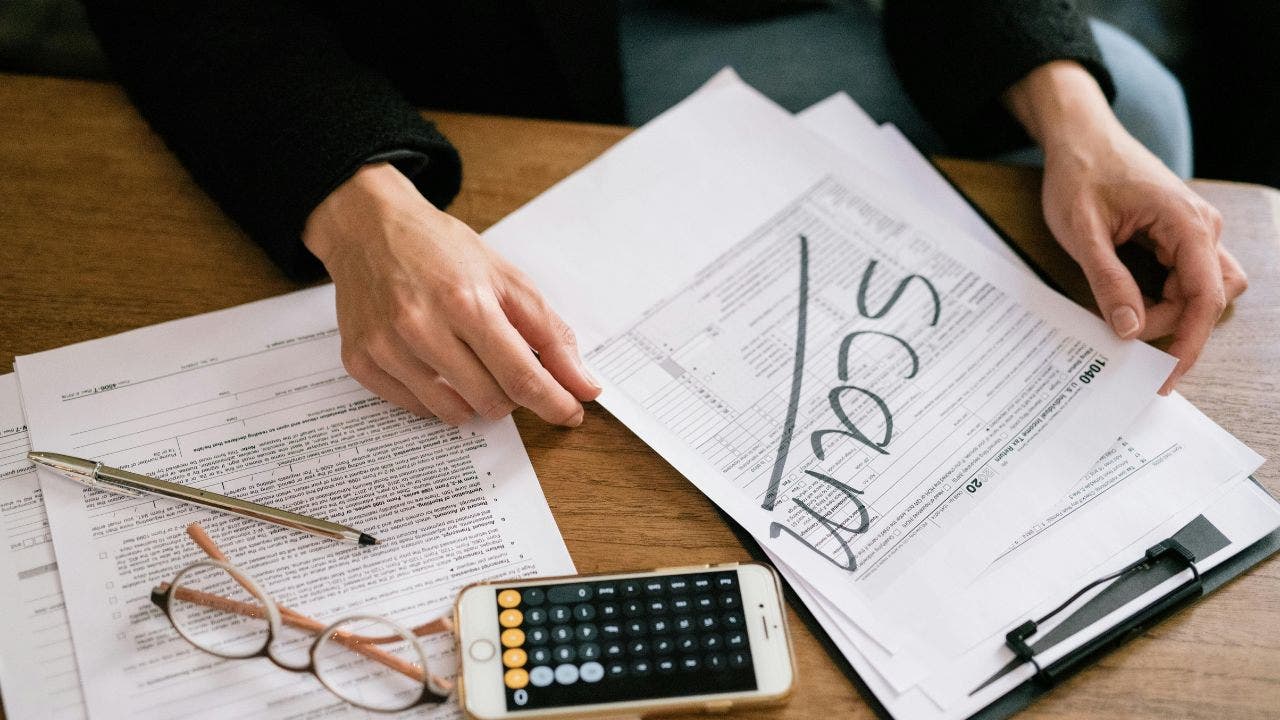

Understanding the Tax Season Scam Landscape

Tax season typically brings with it the anxiety of filing and potential audits, but in 2026, the stakes are even higher. With significant changes to tax filing software and the elimination of free government-provided filing services, confusion is rampant. Scammers seize this moment of uncertainty to launch their deceptive tactics, posing as IRS agents and manipulating taxpayers into surrendering sensitive information.

“Every tax season, we see an uptick in scams, and with the current shifts in filing procedures, this year is no exception,” said Lynette Owens, a consumer marketing expert.

How Scammers Exploit Confusion

The 2026 tax season has ushered in an environment where uncertainty thrives. Taxpayers grappling with new filing rules may inadvertently lower their guard, making them prime targets for fraudulent messages disguised as official communication.

“Scammers thrive on creating confusion. When the rules are unclear, they can craft messages that appear legitimate and exploit the panic around deadlines,” Owens remarked.

Common Tactics Used by Fraudsters

While scam tactics evolve, the underlying strategies remain largely unchanged:

- Fake Refund Alerts: Scammers often send emails or texts claiming a refund is pending, urging immediate verification of personal data.

- Urgent Account Issues: These messages impersonate the IRS and solicit account details under the guise of resolving an 'error.'

- Fraudulent Tax Help Offers: Con artists offer services that claim to expedite refunds, often demanding upfront fees.

Recognizing the Signs

It is critical to remain vigilant as tax season progresses. Be aware of red flags:

- Messages that demand quick action, often accompanied by urgent language.

- Communications requesting personal data via email or text—real IRS communications predominantly occur through postal mail.

- Links directing to sites that mimic official IRS pages.

Practical Steps to Protect Yourself

Taking proactive measures can safeguard you from falling victim to these schemes:

1. Verify Before You Click

Never engage with links in unsolicited messages. Instead, directly visit the IRS website by typing the URL into your browser.

2. Maintain Strong Passwords

Use unique, complex passwords for all tax-related accounts. Consider employing a password manager to generate and store secure passwords.

3. Be Cautious of Offers

Legitimate tax services do not pressure clients for immediate results. Always research any service before sharing personal information.

4. Monitor Your Accounts

Keep a close eye on your financial accounts for any suspicious activity. Prompt attention can help mitigate damage if your data is compromised.

What to Do if You Fall Victim

If you realize too late that you engaged with a fraudulent message:

- Cease all communication immediately.

- Report the incident to the appropriate authorities, such as the IRS and the FTC.

- Monitor your financial accounts closely and consider placing fraud alerts on your credit accounts.

In an era where scams become increasingly sophisticated, a cautious, informed approach is your best defense against fraud. Don't let confusion cloud your judgment—stay ahead of scammers by arming yourself with knowledge.

Source reference: https://www.foxnews.com/tech/tax-season-scams-surge-filing-confusion-grows

Comments

Sign in to leave a comment

Sign InLoading comments...