Understanding the Stakes

The search for a new chair of the Federal Reserve is nearing its climax, with President Trump set to reveal his pick in the coming weeks. This choice, which follows Jerome Powell's impending departure, is crucial as the Fed grapples with political turmoil and internal conflicts on interest rate policies.

In this context, the individual selected will face exceptional challenges, straddling the lines between economic advisement and political expectation. The chosen leader will wade through mounting pressures to adjust borrowing costs while maintaining the Fed's independence—an increasingly delicate balancing act.

The Frontrunners

Here's a closer look at the primary candidates vying for the position:

Kevin Hassett: Loyalist with a Conservative Edge

At 63, Kevin Hassett is a seasoned economist and a steadfast Trump ally, previously chairing the Council of Economic Advisers. Despite early momentum, his prospects have cooled, and skepticism surrounds whether he can navigate the Fed's complexities alongside his commitment to Trump's economic strategies. Analysts are particularly concerned about his perceived lack of independence.

A Deutsche Bank report indicates that not only might Hassett struggle to cultivate consensus among policymakers but he may also find it difficult to convince them to pivot from a hawkish stance toward rate cuts. His insistence on the Fed's independence while suggesting that interest rates have room to fall adds to the intrigue surrounding his candidacy.

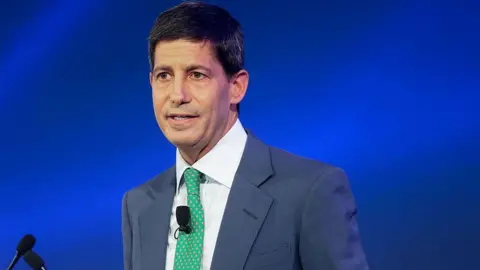

Kevin Warsh: The Contrarian

Kevin Warsh, who served on the Fed board from 2006 to 2011, presents a contrasting vision. Known for his vocal critiques of the Fed's data reliance and asset management, Warsh advocates for what he terms "regime change" at the central bank. Once perceived as hawkish, his recent comments suggest that he might support lower rates in the near term, a complex position given his prior stance on inflation.

Warsh's familial connections to the Trump administration—his in-laws are longtime supporters—could bolster his chances, as he previously garnered attention during Trump's first term. His ability to sway Trump's decision could hinge on Wall Street's perception of his candidacy amidst rising skepticism.

Christopher Waller: The Insider

Currently a Fed governor, Christopher Waller has made recent appearances alongside Trump, enhancing his visibility as a contender. With a steady history at the Fed, he is viewed as a potential stabilizing force amid turbulent times. His views align with the need for lower interest rates and he is seen as less tied to the political environment than Hassett or Warsh, which may resonate positively with mainstream investors.

While Waller may lack the personal ties that could advantage Hassett and Warsh, his calm demeanor and experience may make him a more favorable option in the eyes of the president and Wall Street alike.

The Broader Implications

The dynamics of this leadership change carry substantial implications for both U.S. and global economies. Each candidate embodies differing visions for the Fed's future, with varying impacts on interest rates, inflation control, and economic growth strategies. As Wall Street holds its breath, awaiting Trump's decision, the power of this appointment underscores the intersection of politics and economics—a realm where philosophies clash and market sentiments hang in the balance.

Conclusion

In a world where markets increasingly reflect the sentiment of political leaders, the upcoming Fed chair appointment isn't just a personnel decision; it's a litmus test for the administration's economic vision. As our economic landscape continues to evolve, understanding who will steer the vessel is crucial. Will we see a return to conservative economics, an embrace of more progressive monetary policies, or a balancing act unique to the challenges ahead?

Source reference: https://www.bbc.com/news/articles/c4g907zekllo