Introduction

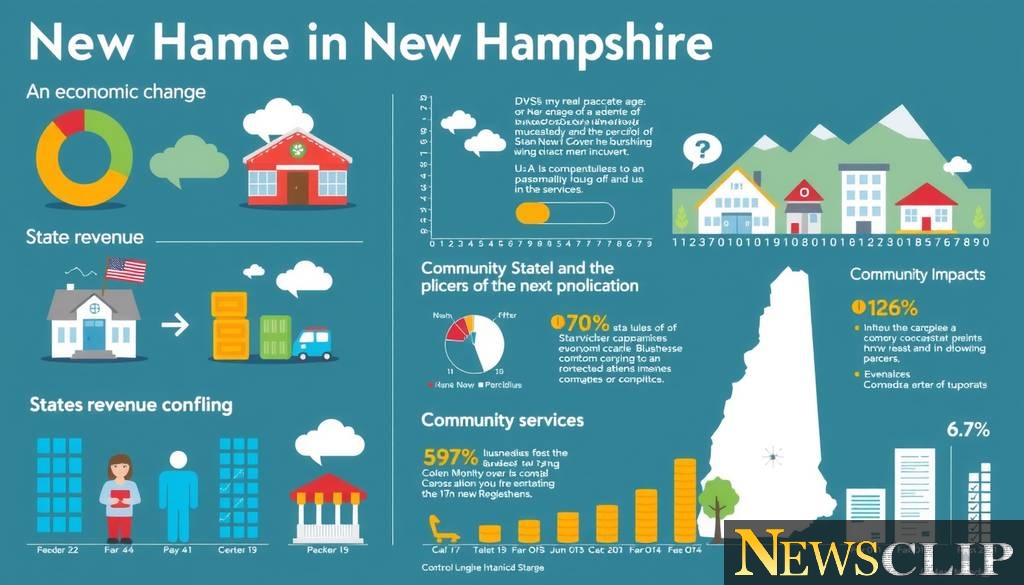

New Hampshire's economy has seen a noteworthy transformation recently, characterized by a significant shift in state revenue. This change is not just a matter of numbers; it reflects broader economic trends that affect both the business sector and the everyday lives of New Hampshire residents. As a Global Business Analyst, I find it essential to examine these shifts not merely through a financial lens, but through the lens of their human impact and consequences.

The Current Revenue Landscape

New Hampshire has long been viewed as a state with a unique fiscal structure. It depends heavily on various sources for its revenue, including taxes on businesses and various fees. Recent reports indicate that this structure is undergoing significant changes, raising both concerns and opportunities.

Key Factors Influencing Revenue Changes

- The economic impact of the COVID-19 pandemic: How recovery has been uneven across sectors.

- Shifts in population demographics: Younger residents are increasingly moving in and out of the state.

- Changes in business taxation: New policies aimed at increasing business investment.

Economic Indicators

“Markets affect people as much as profits.”

If we look at key economic indicators such as employment rates, business growth, and healthcare spending, we can start to paint a more comprehensive picture of New Hampshire's revenues. For instance, as of recent data, the unemployment rate has remained relatively low, which could indicate a robust job market that might bolster tax revenues. However, an in-depth look reveals contrasting narratives between booming industries and those struggling to recover.

The Tech Sector vs. Traditional Industries

While technology firms within the state see growth, traditional sectors like manufacturing have not fared as well. The relative strength of these industries affects the overall revenue generated and, by extension, the funds available for public services. One has to wonder: are our tax dollars keeping pace with the reality of our shifting economy?

Public Services and Budgeting

With changes in revenue stream, the state faces critical budgeting decisions. Education, infrastructure, and healthcare all compete for limited resources. As a strategic observer, I feel it's crucial for policymakers to consider not just where revenue is coming from but its long-term sustainability.

The Importance of Transparent Decision-Making

When discussing budget allocations, transparency should be prioritized. Citizens deserve to understand how their taxpayer dollars are being used and what priorities are being set. This process can help to rebuild trust in public institutions, which has waned in light of recent financial uncertainties.

Future Outlook and Recommendations

Looking ahead, the economic landscape in New Hampshire will continue to evolve. Policymakers need to consider:

- How to diversify revenue sources to shield against future economic shocks.

- Incentives to attract young residents and families who are vital for economic sustainability.

- Balanced approaches to taxation that promote business growth while ensuring adequate public services.

Conclusion

In conclusion, New Hampshire's shift in business revenue is emblematic of broader economic trends that we must navigate with caution and strategic foresight. As I analyze the implications of these changes, I urge stakeholders—from local businesses to policymakers—to engage in open dialogue about how we can work together to build a resilient economic future. The challenge is significant, but with cooperative effort, we can ensure that the evolving economic narrative is one that benefits all residents of New Hampshire.

Comments

Sign in to leave a comment

Sign InLoading comments...