The Historic Milestone

Nvidia has officially reached a groundbreaking market value of $5 trillion (£3.8 trillion), making it the first company to achieve this staggering valuation. The ascent has been swift; just last year, it was valued at $1 trillion, and in June 2023, the company achieved a $4 trillion mark. So, what fueled this rapid growth?

At the core of this rise is Nvidia's strategic pivot towards artificial intelligence (AI), which has transformed the company from a graphics-chip manufacturer to a formidable player in the burgeoning AI industry. Investor enthusiasm surrounding AI's potential has propelled demand for Nvidia's technology, leading to skyrocketing stock prices.

“Nvidia is at the forefront of the AI revolution, and it's no surprise that its value has skyrocketed as AI technologies continue to permeate every sector of our economy,” explains a financial analyst from MarketWatch.

The Role of AI in Nvidia's Success

The company's chips are integral to the functioning of many AI applications, which has resulted in lucrative partnerships with major AI firms like OpenAI and Oracle. For instance, in a landmark deal, Nvidia recently secured a staggering $100 billion investment from OpenAI, further solidifying its position as a leader in AI infrastructure.

The Broader Context

But here lies the complexity: while the euphoria of AI spending is driving valuations into the stratosphere, concerns over potential bubbles are equally rampant. Analysts have raised alarms about overvaluation, with figures such as Danni Hewson of AJ Bell commenting that Nvidia's valuation is so massive it challenges comprehension.

The Economic Landscape

Today's stock market landscape is predominantly influenced by AI-related enterprises, accounting for a staggering 80% of the gains this year. According to the World Bank, Nvidia's value now surpasses the GDP of every country except the USA and China, and stands higher than entire sectors within the S&P 500.

Challenges Ahead

Despite the rapid valuation growth, the cloud of uncertainty hangs over Nvidia. Geopolitical relationships, particularly with China, are fraught with tension. Recent trade policies and the ongoing political dynamics could impede Nvidia's access to this critical market.

- In April, fears surrounding the US-China trade wars caused Nvidia shares to dip.

- Investors are wary of geopolitical tensions impacting revenue streams.

Market Reactions and Future Outlook

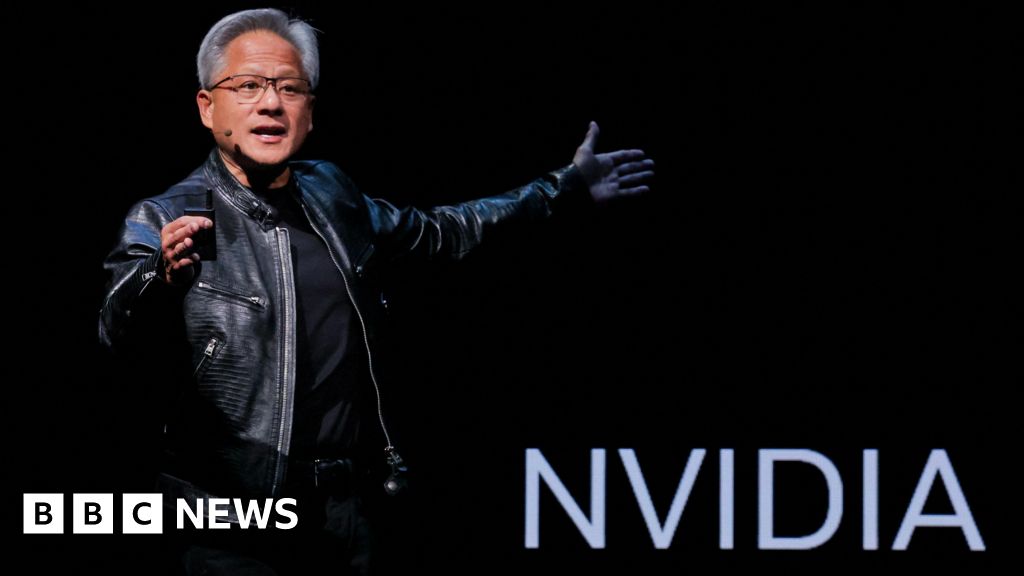

The volatility in Nvidia's stock is underscored by its price surge of over 50% this year alone. The company's Chief Executive, Jensen Huang, recently hinted at $500 billion in AI chip orders for the coming year, adding to the investor optimism that seems to overshadow the cautions voiced by industry veterans.

With regulatory bodies like the Bank of England and the International Monetary Fund expressing concerns over an AI bubble, the question remains: will Nvidia and its competitors sustain this growth, or are we at the precipice of a correction?

Conclusion

As Nvidia continues its hyper-growth trajectory, both excitement and skepticism coalesce in a complicated financial narrative. I will be closely monitoring this situation, dissecting the complexities of AI advancement against a backdrop of economic and geopolitical uncertainty. Will Nvidia remain the beacon of innovation, or will it falter under the weight of its unprecedented valuation? Only time will tell.

Source reference: https://www.bbc.com/news/articles/cp8e970vn5vo