The Rise of Nvidia: Breaking Records

Nvidia has once again outdone itself. In its latest quarterly earnings report, the chip giant boasted a staggering 62% increase in revenue, hitting $57 billion for the three months leading up to October. This growth is largely driven by soaring demand for its AI chips, particularly within data centers. It's evident that Nvidia is not just keeping pace; it is setting the pace in the rapidly evolving AI landscape.

Market Sentiment: A Mixed Bag

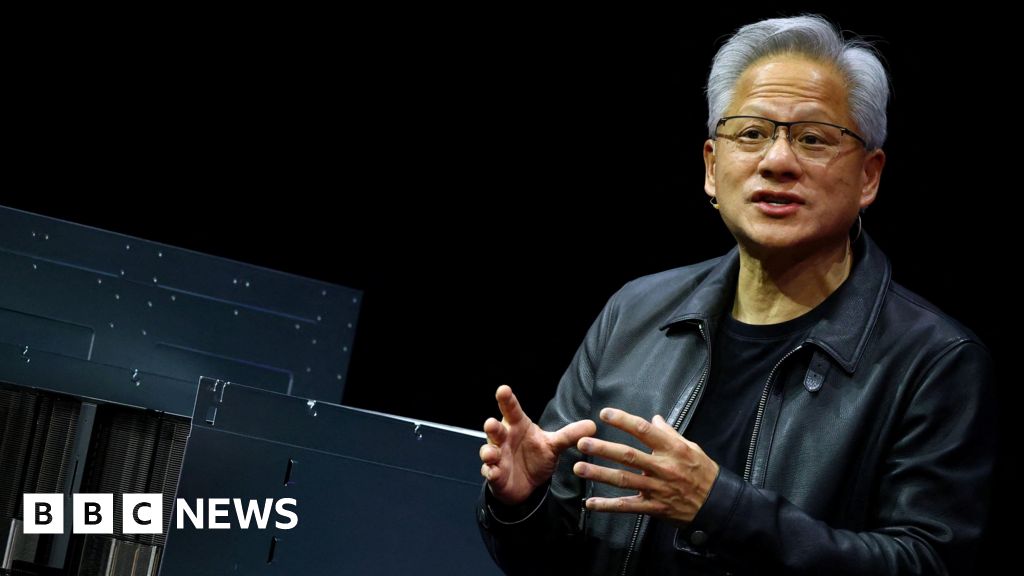

Despite this remarkable performance, concerns linger about an overvalued AI market. Chief Executive Jensen Huang commented that sales of its AI Blackwell systems are "off the charts," asserting confidence even amid widespread discussions of an AI bubble. His sentiment comes against a backdrop of declining stocks elsewhere; the S&P 500 has recorded four consecutive drops as investors grapple with potential returns on AI investments.

"From our vantage point, we see something very different" - Jensen Huang

Future Expectations

Nvidia's forecasts for fourth-quarter sales are equally impressive, ranging up to $65 billion, surpassing analyst expectations. This optimistic outlook instigated a 4% increase in after-hours trading for Nvidia shares.

The Broader AI Landscape

Nvidia's performance is crucial not only for its own health but also for the overall tech sector. With heavyweights like Meta, Alphabet, and Microsoft also ramping up AI investments, the intersection of technology and economics becomes more pronounced. These companies have been pouring substantial resources into AI, which, while promising, prompts discussions about market stability and valuation.

Investor Reactions

As Nvidia's shares climb, experts suggest that this is a defining moment not just for Nvidia but for investors who have been cautious about the tech sector's meteoric rise. Commentators have remarked that the question isn't whether Nvidia will exceed expectations, but rather by how significantly it will do so.

- Adam Turnquist, chief technical strategist for LPL Financial, highlights the growing acceptance of Nvidia's leadership in the AI space.

- Matt Britzman, a senior equity analyst, believes Nvidia's valuations remain distinct from the broader AI sector, which may need recalibration.

Concerns Around Regulation and Future Deals

Colette Kress, Nvidia's CFO, expressed disappointment regarding U.S. regulatory hurdles that restrict chip exports to China. This raises valid questions about Nvidia's long-term strategy and relationships with global partners. Notably, NVIDIA has embarked on a significant collaboration, partnering with Elon Musk's xAI at a new data center set to be outfitted with hundreds of thousands of Nvidia chips. Such partnerships demonstrate Nvidia's central role in the global AI architecture.

The Bigger Picture

Beyond analysis of Nvidia's quarterly report, the implications for the global economy are tremendous. As we navigate through this uncertain terrain, evaluating the human impact of such financial maneuvers is crucial. The balance between innovation and speculative investment has never been more critical. While the current AI boom is indeed promising, let us not ignore the cautionary tales from past market surges.

Conclusion: A Watchful Eye on AI Growth

As Nvidia continues to blaze trails in the realm of chip manufacturing for AI applications, we must remain vigilant about the sustainability of this growth. The drive for revenue must not overshadow the potential risks associated with market bubbles and regulatory landscapes. What's clear is that Nvidia stands as a bellwether for the tech industry, and its performance will be closely scrutinized in the months to come.

Source reference: https://www.bbc.com/news/articles/cly4y2enywro