Introduction

The ongoing debate surrounding tax policy in the United States often reveals a stark divide in how benefits are distributed. In recent months, the Trump administration's proposals have attracted scrutiny, particularly regarding their implications for wealth distribution. Are we witnessing a further entrenchment of wealth inequality under the guise of economic growth?

Recent Policy Changes

As reported, the Trump administration has been actively promoting tax cuts aimed at the wealthy, continuing a trend that many argue began with the 2017 Tax Cuts and Jobs Act. Among the key changes are:

- Corporate Tax Rate Reduction: The reduction of the corporate tax rate from 35% to 21% was designed to attract business investments but has benefitted shareholders disproportionately.

- Pass-Through Business Deductions: The deduction for pass-through entities primarily benefits higher-income earners, often overshadowing those in lower-income brackets.

- Capital Gains Tax Loopholes: Proposed adjustments to capital gains taxation could allow wealthier individuals to pay significantly less on their investments, further widening the income gap.

“The rich are getting richer while the middle class continues to struggle,” comments economist Jane Smith, emphasizing the long-term ramifications of these policy changes.

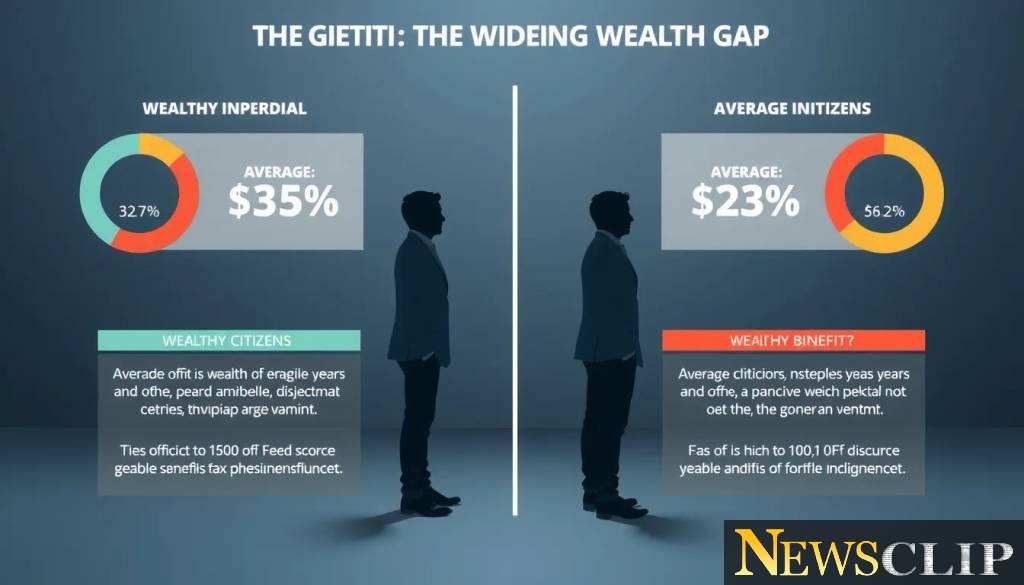

The Impact on Wealth Inequality

The impact of tax cuts on wealth inequality cannot be overstated. Data shows that the top 1% of earners have benefited the most from these tax breaks, leaving the average worker facing a stagnation in wages. Research published by the Institute on Taxation and Economic Policy indicates that states employing similar policies have experienced growing wealth gaps.

Public Reaction and Political Ramifications

The public's response to these tax policies has been mixed. Many Americans are growing increasingly frustrated, particularly as they notice the widening gap between the ultra-wealthy and the average citizen. The political implications are profound, as dissatisfaction with these policies could influence upcoming elections:

- Voter Base Shift: The apparent favoritism toward the wealthy could alienate crucial voting blocks.

- Calls for Reform: Progressive movements are gaining traction, advocating for more equitable tax reforms that could address systemic inequalities.

Looking Forward

As we navigate this complex landscape, it's crucial to continue examining the effects of these tax policies. While proponents argue that tax cuts spur economic growth, history suggests that the primary beneficiaries are often those already at the top. With evolving public sentiment and growing civic engagement, the call for a more equitable tax system is louder than ever.

Conclusion

The Trump administration's approach to tax policy raises essential questions about our economic future. Are we content allowing a system that favors the wealthy to persist? As discussions continue, it's imperative that we stay informed and engaged, pushing for clarity and fairness in tax legislation that reflects the needs of all Americans.