Introduction

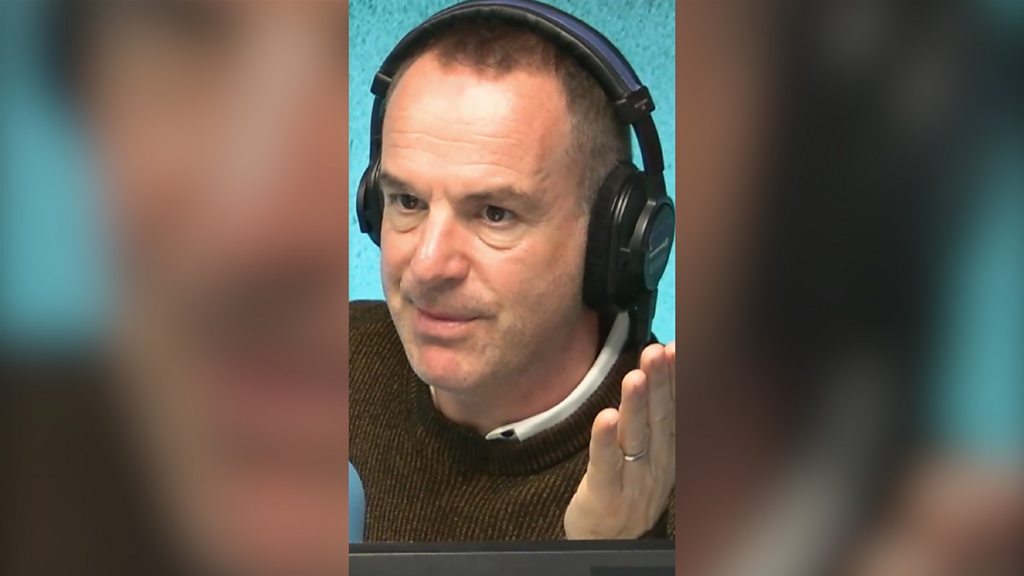

With the holiday season around the corner, the pressure on finances becomes palpable. We all want to make our celebrations memorable without breaking the bank. Enter Martin Lewis, a revered voice in personal finance, who offers actionable insights on how to tap into the potential of bank switching to gain substantial rewards.

The Power of Switching Banks

In today's competitive banking landscape, financial institutions are keen to attract new customers. They often offer cash incentives for balancing transfers and new accounts. Lewis highlights how a strategic switch can yield up to £400, depending on the bank and the offers available.

Why Switch?

- Financial Incentives: Many banks are providing enticing bonuses that can help offset holiday expenses.

- Better Interest Rates: It's not just about the cash; better accounts often come with higher interest rates on savings.

- Improved Services: Switching often leads to discovering better customer service and online banking features.

How to Make the Switch

"Switching your bank shouldn't feel daunting. It's a simple process that can have significant benefits if you approach it strategically.” - Martin Lewis

Here's a simplified breakdown of the steps you should follow if you're considering making the switch:

- Research Options: Start by researching which banks have the best offers available. Use sites like MoneySuperMarket for comparison.

- Check Eligibility: Make sure you meet the requirements for the cash incentive, such as depositing a specific amount.

- Initiate the Switch: Most banks will handle the switch for you, but ensure to monitor the transition to safeguard against any issues.

Things to Consider

While switching can be beneficial, it's essential to be mindful of potential downsides:

- Credit Impact: Frequently switching accounts may impact your credit score—be cautious.

- Fees: Be aware of any fees that could apply to new accounts or transactions.

- Accessibility: Consider the accessibility of the bank's services—branches, ATMs, and online banking options.

Timing Your Switch

The timing of your switch can be crucial, especially if you're looking to cash in before the holidays. Lewis suggests that getting started early is always better to avoid a last-minute scramble, as processing may take several weeks.

Conclusion

In the end, the potential earnings from switching bank accounts can provide much-needed relief during an expense-heavy period. By following the guidance of experts like Martin Lewis, not only can you enhance your financial situation, but you can also navigate the complexities of banking with greater confidence.

As we step into this season of giving, let's ensure that we balance our generosity with savvy financial management. Happy bank switching!

Source reference: https://www.bbc.com/news/videos/c751l9x9370o