Introduction

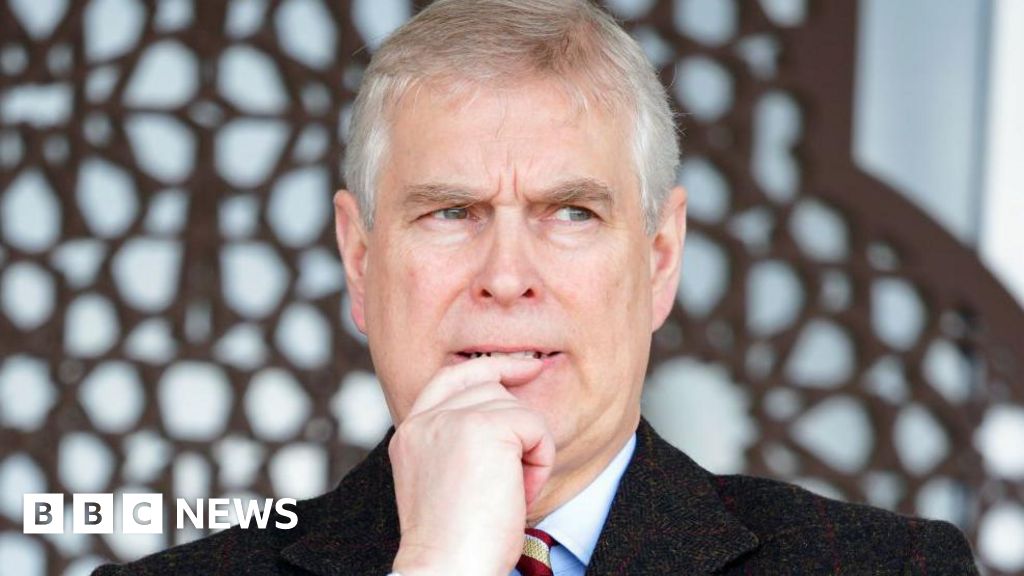

The recent release of emails related to Jeffrey Epstein has shed light on Prince Andrew Mountbatten-Windsor's business relationships, particularly concerning David Rowland, a controversial financier. What emerges from these communications is not just a glimpse into royal financial strategies but a troubling narrative about trust, influence, and reputation.

The Emails: A Closer Look

The emails, which have recently surfaced, indicate that Prince Andrew regarded David Rowland as his "trusted money man." This relationship raises significant questions, especially given the public's perception of Rowland as a "shady financier." In these exchanges, we see Andrew promoting Rowland's financial ventures while simultaneously navigating his role as the UK trade envoy, a position that inherently carries a degree of responsibility and public scrutiny.

“Will finalize F summary for you next week. Can't now cause she went to Nepal, paying for the first-class flight with her Rowland bank loan.”

This comment suggests that Andrew's financial entanglements extend beyond business, affecting personal relationships, notably involving his ex-wife, Sarah Ferguson. It raises the question: how deeply are family finances intertwined with the business interests associated with his royal status?

Epstein's Reluctance

Interestingly, while Andrew championed Rowland's ventures, Epstein seemed hesitant. Reports indicate Epstein was cautioned about Rowland's reputation, which had been tarnished in part due to media scrutiny, presenting him as a risky association for anyone, let alone a high-profile individual like Epstein. This wariness is emblematic of the caution necessary when securities are at stake; it highlights a larger commentary on perceived legitimacy in the financial world and the royal connections.

The Rowland Family's Defense

Jonathan Rowland's statements further complicate the narrative. He has emphatically denied any direct financial exchanges or meetings involving Epstein, arguing that any payments to Andrew or Ferguson were not tied to their royal connections. Whether such denials can hold credibility in the face of mounting circumstantial evidence remains to be seen.

Regulatory Scrutiny

Moreover, Rowland's private bank, Banque Havilland, has faced regulatory setbacks, including a bankruptcy in 2024. This adds another layer of complexity to Andrew's relationship with the bank and raises questions about the sustainability of such financial ties. If one considers the broader implications, this could not only affect Rowland's reputation but also Andrew's own standing as a former trade envoy.

Critique: The Larger Implications

While Andrew maintains that he has done nothing wrong, the unfolding story prompts a reflection on the interconnections between royal privilege and financial autonomy. The pursuit of profit in tandem with public service poses an ethical dilemma that transcends this particular case. If the lines between personal and professional finances are blurred, what are the ramifications for public trust in royal figures?

A Future of Scrutiny

The scrutiny over Prince Andrew's finances is likely to continue, particularly as more information becomes available. With both the media and public eye focused heavily on these revelations, the question remains: can he successfully navigate these treacherous waters without tarnishing the royal family's reputation even further?

Conclusion

As we delve deeper into the complexities of this case, it becomes clear that the intertwining of financial necessity and royal duty can lead to challenging narratives that demand a measured perspective. The unfolding story requires not just attention to the details but an understanding of the broader impact on public perception and royal integrity.

Source reference: https://www.bbc.com/news/articles/c1kldw1e0w3o

Comments

Sign in to leave a comment

Sign InLoading comments...