The Context of Sanctions on Venezuela

The U.S. has imposed sanctions on Venezuela for years, primarily targeting its political leadership under Nicolás Maduro. These sanctions, aimed at curbing corruption and human rights abuses, have significantly impacted not just the Venezuelan economy, but global oil markets.

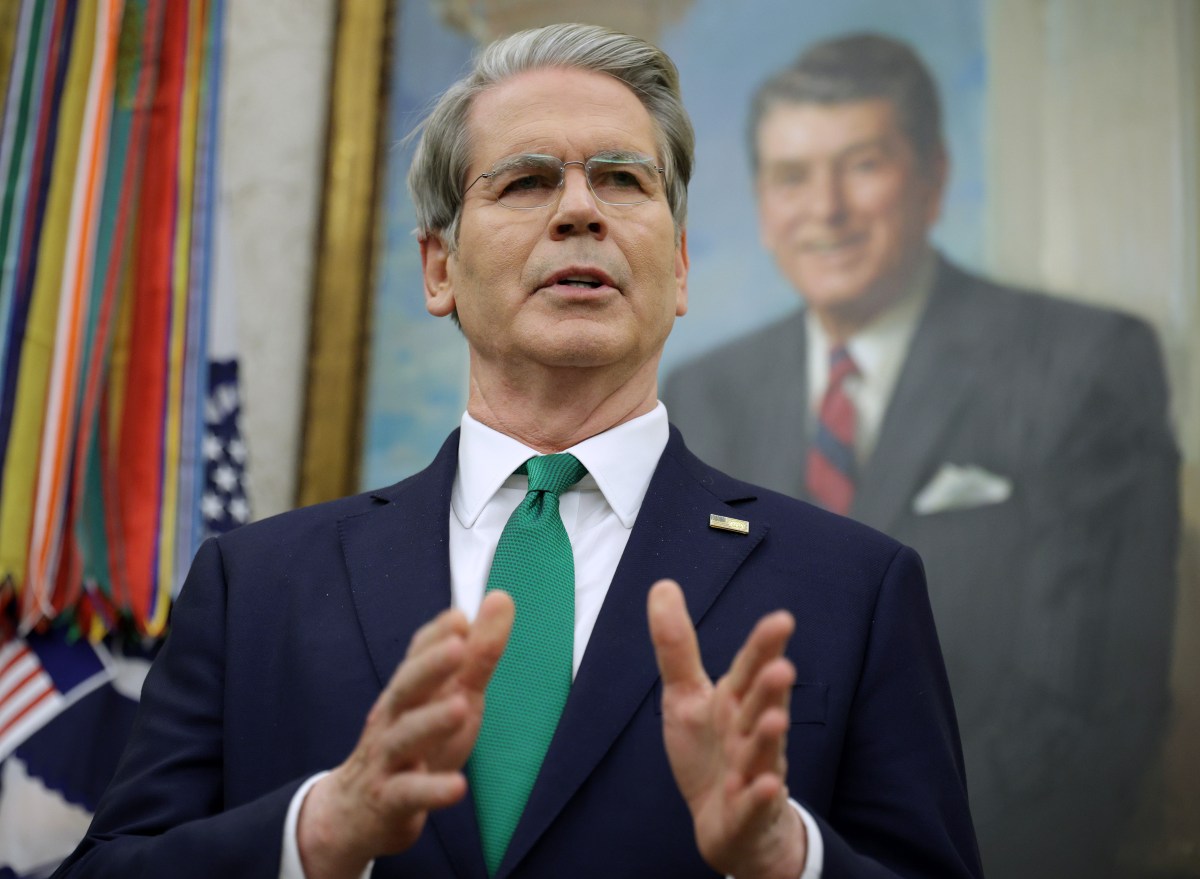

During an interview, U.S. Treasury Secretary Scott Bessent indicated that lifting these sanctions might be imminent, aiming to revitalize the oil sector that's been in decline. The U.S. government views this as an opportunity to access Venezuela's vast oil reserves, critical for meeting global demand amidst fluctuating prices.

What This Means for International Relations

The decision to lift sanctions could spark a wave of dialogue between the U.S. and Venezuela, and might also influence relations with other countries, particularly those that have been adversarial towards American interests. As reported by Reuters, discussions are ongoing about how much support institutions like the IMF and World Bank are willing to offer Venezuela. This is crucial for re-establishing the infrastructure needed for oil production.

"We need to assess how we can stabilize the country while unfreezing assets to stimulate oil production," Bessent remarked.

The Strategic Importance of Venezuelan Oil

Venezuela holds one of the largest oil reserves globally, with the capacity to produce millions of barrels daily. Historically, Venezuela's oil production figures have plummeted due to mismanagement and lack of foreign investment, especially since nationalization in the 1970s. Reviving this sector may not only benefit the Venezuelan economy but also provide the U.S. with vital energy resources.

- Challenges Ahead: Re-establishing production can be complex.

- Legal Implications: Necessary changes in legislation must be addressed.

- Collaborations: The U.S. may partner with foreign oil companies to revitalize production.

Experts have echoed this sentiment, cautioning that for production to ramp up effectively, decades of neglect and underinvestment must be addressed. According to energy analysts, revitalizing the sector could require up to $100 billion in investment.

The Road Ahead

As transformative as lifting these sanctions might be, the pathway is fraught with negotiation and uncertainty. Bessent has stated that the U.S. is examining how to facilitate the repatriation of oil revenues back to Venezuela. This revenue is essential not only for restoring governmental functions but also for stabilizing the region, as social unrest becomes a concern with the lifting of sanctions.

"How can we ensure that this oil wealth benefits the Venezuelan people? This is a question at the forefront of our negotiations," said Bessent.

Public and Private Sector Responses

Within the energy sector, executives are cautiously optimistic. Exxon CEO Darren Woods voiced concerns about the immediate investability of Venezuela but acknowledged the potential under the right conditions for sustained foreign engagement. This crucial endorsement from oil executives signifies a step away from extreme caution, hinting at a complex yet achievable relaunch of operations.

Conclusion

Lifting sanctions is a pivotal move, with far-reaching ramifications not just for Venezuela but also for global energy dynamics. I will continue to follow this developing story and delve deeper into what it means for the involved parties.

Source reference: https://www.newsweek.com/us-lift-venezuela-sanctions-ease-sale-oil-bessent-11341378