Understanding the Scope of Minnesota's Fraud Crisis

The recently uncovered fraud epidemic in Minnesota is not merely about local inefficiencies; it encapsulates a national crisis that has been festering beneath the surface for years. With staggering reports suggesting multi-billion dollar losses, underscored by the alarming statistic that taxpayer losses from fraud in state-administered benefit programs such as SNAP and Medicaid have surpassed $2.3 trillion since 2003, the implications are profound.

As I reflect on the situation, I'm struck by the interconnectedness of deceit and desperation that permeates our social safety nets. It's unsettling to consider that a system designed to support the vulnerable instead serves as a playground for crime and exploitation.

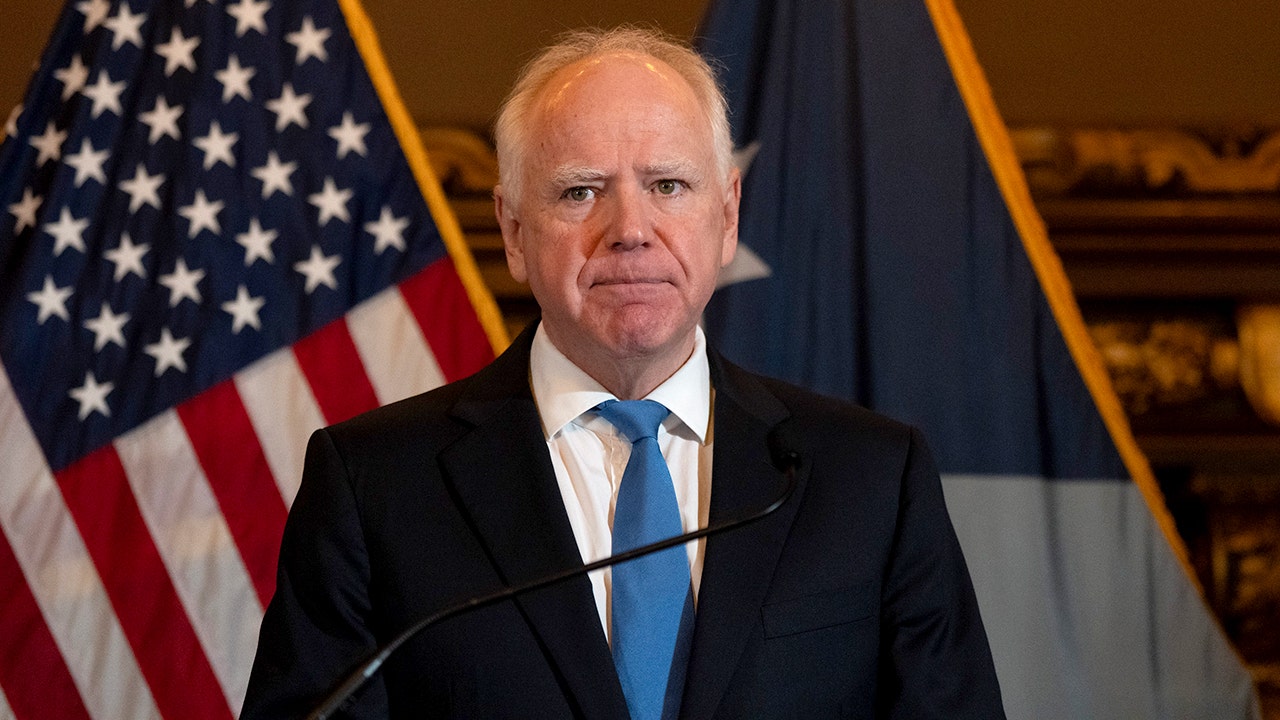

Tim Walz's Dilemma

Governor Tim Walz finds himself at a crossroads. The situation demands a swift and decisive response, and how he navigates this crisis could very well define his political legacy. Ironically, this scandal may catalyze long-overdue reforms that have been resisted for years, presenting an opportunity among the chaos.

“The Minnesota fraud machine is a symptom of a larger issue, a culture of complacency that has stifled accountability and scrutiny.”

What's At Stake

The ramifications extend far beyond Minnesota. The dysfunction exposes a patently flawed system where state governments have often buried their heads in the sand, allowing fraudsters to siphon taxpayer dollars unchecked. According to a 2025 report, California's fraud alone exceeded $70 billion, illustrating that Minnesota's troubles are just the tip of the iceberg.

Fraud has woven itself into the fabric of several benefit programs, wreaking havoc on resources intended for the most needy. This exploitation by unscrupulous agents not only burdens the system but further erodes public trust in government institutions. As I dissect these issues, the need for transparency becomes paramount.

Systemic Changes Required

A fundamental shift in approach is non-negotiable. Reliance on outdated anti-fraud systems has hampered effective oversight, with manual processes susceptible to human error. We must advocate for comprehensive reforms that incorporate advanced data analytics as a preemptive strike against fraud.

The Federal Government must take the helm, insisting on a national audit of fraud prevention systems. The integration of artificial intelligence into fraud detection, coupled with robust auditing practices, can significantly mitigate abuses and protect taxpayer interests.

Modernization of Policies

My experiences in the FBI have underscored the urgency of modernization. Advanced data analytics and machine learning techniques have helped organizations pinpoint irregularities swiftly and effectively. To quote the ancient Greek tragedian Sophocles, “What is not sought will go undetected.” This holds ever truer within the realm of fiscal oversight, where passive frameworks lead to gaping vulnerabilities.

Political Will and Public Outrage

Yet, herein lies the challenge: achieving the political will necessary for change. Historically, certain political paradigms have taken a hands-off approach, prioritizing immediate voter satisfaction over long-term solvency. This is not purely a partisan issue; it's a crisis demanding collective accountability.

The outrage among taxpayers could catalyze calls for reform, forcing politicians to take a stand against the status quo. It's high time we address the systemic flaws allowing this kind of fraud to persist and become the norm.

A Call for Action

Moving forward, the pathway seems clear: We need collaborative efforts between federal and state authorities, utilizing resources effectively to stem the tide of fraud. Who will be brave enough to confront this issue head-on? I urge all stakeholders to participate in a dialogue that drives meaningful legislative action.

As we look closely at the dire situation in Minnesota, it may serve as a dark reminder of our shared responsibilities and the pressing need for collective advocacy against systemic fraud. Only then can we hope to mitigate losses and restore faith in our benefit programs.

Conclusion: A Second Chance

In conclusion, perhaps this moment serves as a second chance. The Minnesota scandal, while dire, presents an opportunity to revamp a system in dire need of reform. We owe it to taxpayers to ensure their hard-earned dollars are allocated responsibly—one failure after another should not dictate our societal efforts in the future.

Source reference: https://www.foxnews.com/opinion/walzs-minnesota-mess-could-spark-toughest-fraud-reforms-decades